Flood, Fire, or Storm Damage—How Emergency Loans Step In

Sandhya is a smart financial investor and has all his investments and SIPs on track. She even has medical and term life insurance to protect her family in case of any emergency or unplanned expense.

Now you might think Sandhya has done everything to secure his home and family, right? Well, there is one thing missing from his financial plan: planning for unplanned emergencies.

Just when you think you have done everything right, a flood, a fire, or a storm can sweep through, leaving behind damage you never thought you’d face. The financial burden it can leave behind can be tremendous, but the emotional toll is as significant.

This is when an emergency loan can come in handy, giving you access to the funds that you desperately need in such situations.

What Exactly Is an Emergency Loan?

An emergency loan is similar to a personal loan. It is unsecured, which means you do not pledge your home or other property. This makes the process simple and fast.

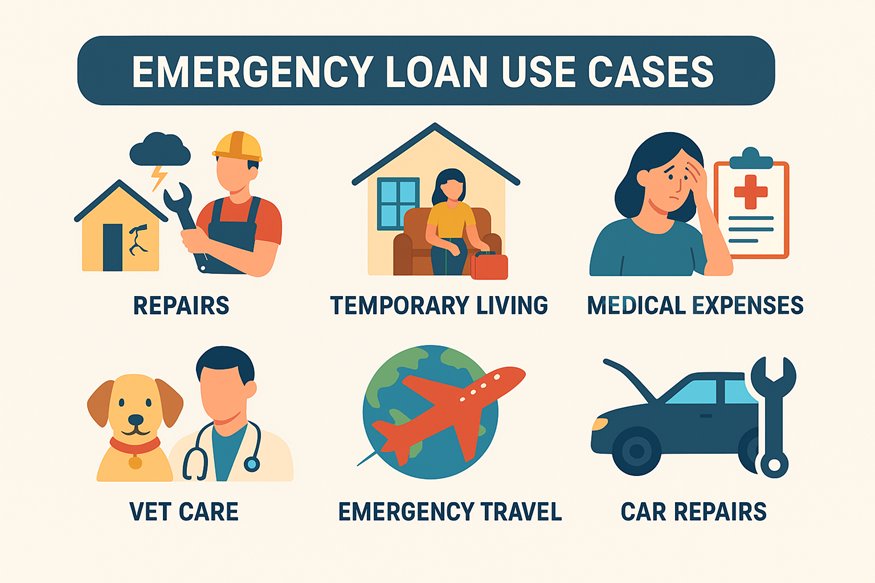

The money goes directly into your bank account, and you can use it for anything, like:

• Repairs: Pay for a new roof, fix electrical systems, or restore fire damage

• Temporary Living: Cover rent or hotel costs

• Medical Bills: Pay for injuries from the disaster

• Replacements: Buy new furniture or clothes

With Hero FinCorp, you can check your eligibility instantly and get access to funds quickly through the instant personal loan app.

Why Is an Emergency Loan a Good Choice?

In times of calamity, one might consider borrowing from family or using a credit card.

However, in most cases, these are not reliable or come with high interest rates. An emergency loan makes sense here as:

• Fixed Repayments: Interest rates on credit cards are frequently high and change over time. You receive a set interest rate and consistent monthly payments when you take out an emergency loan. This is perfect for financial planning.

• Quick Processing: Online emergency loans are fast. You can apply online and get approval in minutes with minimal paperwork. No need for any physical documentation.

• Zero Collateral: Even in times of duress, you can get peace of mind since your home or other assets are not at risk.

How to Get an Emergency Loan Fast?

Getting an emergency loan is easy with a digital lender like Hero FinCorp's Personal Loan App.

The process is quick and easy. All you need to do is:

1. Check Eligibility: Use the app to confirm your income, credit score, and other pertinent information.

2. Prepare your documents: Your proof of income, Aadhaar card, and PAN card are required.

3. Apply Online: Once the verification process is complete, complete the application and proceed with the loan processing.

Tips to Strengthen Your Emergency Loan Approval Chances

Although emergency loans are faster and require minimal paperwork, approval depends on multiple factors.

Here are a few ways to improve your chances of approval:

• Maintain a good credit score of 750 or higher if possible

• Pay off all outstanding EMIs on schedule, at least for the previous three months.

• Maintain up-to-date income documentation, such as pay stubs, bank statements, or other financial records.

• Avoid applying for more than one loan at once, as this will lower your credit score.

Need funds now? Check your personal loan eligibility in minutes with the Hero Digital Lending App, available on both Android and iOS.

Conclusion

Floods, fires, or storms, or any other calamity, can throw your life into chaos! But they don’t have to derail your financial stability. An emergency loan gives you the support you need in these testing times, without exhausting your savings.

And with Hero FinCorp, the process is extremely smooth and hassle-free. You can get loans of up to Rs 5 lakhs for a minimum monthly salary of ₹15,000 in just 10 minutes. So why wait? Install our app and apply today to secure your emergency funds instantly and regain peace of mind!

Frequently Asked Questions

1. What can I do if I want a 1 lakh Rupee loan urgently?

In case of urgent need for money, an emergency loan can prove to be the best solution for immediate financial help.

Similar to a personal loan, it provides faster approval and money transfer because it is intended for immediate requirements like disaster relief or medical expenditures.

2. What are the documents required for an emergency loan?

You will require basic documents for KYC, such as income proof, residence proof, and others. For the majority of digital providers, you will only have to upload documents as required by the provider in order to receive swift disbursement of funds.

3. Will my credit score affect my chances of getting an emergency loan?

Unfortunately, yes! An emergency loan is awarded according to your credit history. But your lenders also verify your income, ability to repay, and more. So you still might be eligible if you have a good credit rating.

4. How much can I borrow with an emergency loan?

Your salary, credit score, credit history, and other factors like outstanding debts will all be taken into consideration when determining how much you can borrow. Depending on these factors, Hero Fincorp offers simple loans up to ₹5,00,000.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.